Surviving the General Product Safety Regulation: Challenges for small businesses

Written by: Sahana Suraj, Peter Holmes

As the UK’s largest trading partner, any legislative changes to trade rules within the EU impact the UK’s trade with the EU. The EU General Product and Safety Regulations (GPSR), entering into force on December, is a case in point that will especially impact any small businesses conducting online sales.

The objective of this piece of legislation is to safeguard consumers in the EU against potentially dangerous products. By progressing from a Directive to a Regulation, the EU GPSR harmonises the product safety blueprint at an EU-wide level, to ensure consistency across all member states. In essence, the GPSR applies to any products placed on the EU market that have not already been regulated by existing EU harmonised legislation. The updated regulation is a significant revision of its predecessor, the EU General Product Safety Directive 2001/95/EC and builds on the Regulation (EU) 2019/1020 on Market Surveillance and Compliance of Products. While these rules have long applied to exports to the EU and Northern Ireland (under the Windsor Framework), the updated GPSR eliminates exceptions relating to the presence of an EU-based authorised representative. All small businesses selling online or through mail order must now have an Authorised Representative based in the EU or Northern Ireland. These businesses are the most affected by the change, as most large companies are already compliant and have either adapted or exited these markets. Micro and small-sized businesses are likely to be especially affected, as they often specialize in niche production, catering to highly specific and smaller market segments.

Where does the updated GPSR differ?

The key aspect of the change is related to the roles of Authorised Representatives. EU law identifies economic operators as encompassing an EU-based importer, an EU-based manufacturer, an EU-based fulfilment service provider, a distributor (a legal actor in the supply chain different from the manufacturer or importer) or an authorized representative acting on behalf of the manufacturer[1]. The updated GPSR requires the relevant economic operators to ensure that products circulating within the EU market comply with the necessary safety guidelines as required by the regulation. Firms with no base in the EU must appoint an authorised representative (who may be the EU importer). They are responsible for regularly verifying that products conform to the supporting technical documentation necessary to ensure product safety.

The complexity for UK exporters arises from the GPSR Regulation, which mandates that for products within the scope of the regulation, non-EU based sellers are required to identify an authorised representative or distributor, based within the Union. This representative will be liable to act on their behalf and assume the obligations of manufacturers stated in the regulation. An obligation of this nature has existed since the 2019 Market Surveillance Regulation, but it has now been extended to include a wider range of products. Specifically, products sold through listings on online marketplaces and mail-order businesses are now subject to the same compliance requirements[2]. For manufacturers based outside the EU, the contact details of the EU-designated economic operator must be clearly indicated on the product or its accompanied packaging.[3] This becomes an additional challenge for businesses from all third countries, including the UK, that directly export to EU member states. A further complication for the UK is regarding the Windsor Framework. GB-based sellers exporting into the EU or Northern Ireland have been subject to the 2019 Market Surveillance Regulation since 2021 but now face heightened requirements to access both Northern Ireland and EU markets while demonstrating compliance with GPSR. The consequential problems are likely to be higher for small UK businesses lacking operational offices within the EU.

A secondary and significant change introduced by the GPSR is the requirement to maintain technical documentation that reflects the expanded definition of a safe product. The updated GPSR considers additional aspects such as product design, technical features, composition, packaging, and instructions for assembly in its safety assessment. To demonstrate compliance, manufacturers and importers are now required to ensure internal risk assessments reflect the consideration of new safety dimensions. Sellers are also required to maintain the results of the risk assessment for a period of up to ten years after the product has been placed on the market. The rules underpinning labelling requirements have also been tightened to include more specific details. Manufacturers need to ensure that their products bear a type, batch, serial number or other element enabling the identification of the product. Information regarding name, their registered trade name or registered trademark and the manufacturer’s postal and electronic address need to be placed on the product or on any packaging accompanying the product. For small-scale producers of handcrafted goods or custom orders, this means dedicating considerable time and resources to assess each of these aspects for compliance, which may not align with the often variable nature of their products. The maintenance of comprehensive and consistent documentation also requires investment in record-keeping and administrative systems, with operational expenses that can reduce profit margins for these businesses. Moreover, many small businesses rely on external suppliers for raw materials or components. The requirement to ensure that their suppliers also comply with these regulations adds another layer of complexity. For micro-businesses or solo entrepreneurs who lack the infrastructure to engage in supplier audits, this is likely to be a substantial obstacle. The failure to comply with any of the obligations may result in penalties determined by individual member states[4].

What does it mean for the UK?

The changes to the EU General Product Safety Regulation are fundamentally tied to trade facilitation challenges for manufacturers based in the UK, exporting to EU and NI markets. Trade facilitation problems raise administrative burdens on exporting firms by increasing the complexity and costs associated with meeting regulatory and logistical requirements.

The Administrative Burdens Advisory Board’s annual Tell ABAB Online Survey consistently highlights that the administrative tasks associated with imports and exports remain a significant challenge for small businesses when exporting to EU markets. These include demonstrating compliance through inspections, maintenance of paperwork, and associated fees. Addressing these burdens not only requires additional resources but will also slow down processes required to place products on consumer markets, making trade less efficient for smaller firms. In anticipation of the GPSR’s enforcement date, many UK small businesses have opted to stop exporting to EU markets. The additional administrative requirements, such as packaging updates and the costly obligation to appoint an EU-based economic operator, are financially unviable for many exporters[5].

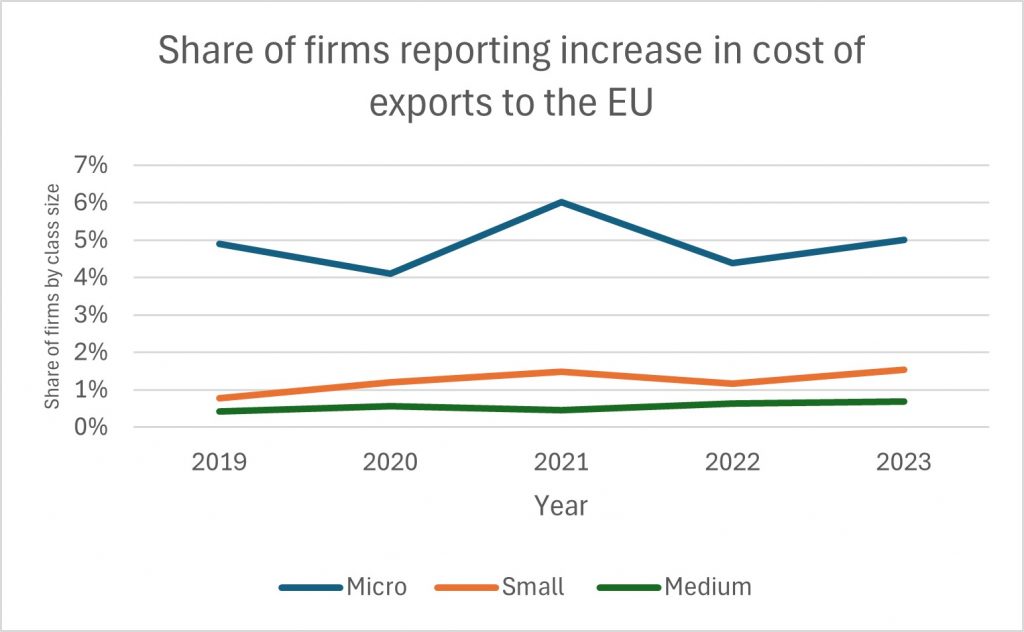

From the surveyed sample of firms in the Longitudinal Small Business Survey published by the UK Department for Business and Trade, a larger proportion of micro and small-sized businesses report an increase in costs while exporting to the EU. Larger firms possess the advantage of spreading the costs of compliance across more products or markets. In contrast, micro and small businesses often lack this benefit, making compliance disproportionately expensive.

Fig 2: Costs of exports to the EU by business size[6]

Source: UK Longitudinal Small Business Survey 2023 published by the UK Department for Business and Trade.

These observations provide insights into the number of small firms that directly export to the UK, which has been declining over the years. Novy et.al (2024) indicate that the number of small businesses (with fewer than 10 employees) exporting to the EU has reduced by 20,000 in 2019 when compared to previous years.

The Road Ahead

Navigating the GPSR presents significant challenges for small businesses operating in niche markets. To help these enterprises succeed, a multifaceted approach is needed.

Given the EU Policy, the UK government must evaluate its options to provide support to help SMEs deal with compliance costs. Previously grants have been provided by the UK government for SMEs that trade only with the EU to deal with customs procedures and new VAT rules as a result of Brexit[7]. Building on these initiatives, the government now needs to prioritize research into evolving compliance procedures and monitor how these shape export opportunities for SMEs. This will ensure targeted support for their competitiveness in global markets.

The lack of timely updates was a primary concern reported by UK-based small business exporters regarding the GPSR, and compliance with its requirements[8]. The delayed communication and insufficient guidance created uncertainty, making it challenging for these businesses to align their operations with the new regulatory expectations. Moving forward, the UK government needs to closely monitor legislative updates in the EU, as they could impact trade, especially given the EU’s significant share of the UK’s trade portfolio and its critical role in providing access to consumer markets.

Given the increasingly close trade relationship between the EU and the UK, there is greater potential to address trade facilitation challenges in the EU, compared to other international markets. In this regard, leveraging the Trade and Cooperation Agreement (TCA) can be essential for achieving this goal. This becomes increasingly important at a time when the UK attempts to ‘reset’ its relationship with the EU, requiring careful monitoring and adaptation of trade policies to ensure alignment and minimize disruptions. Ultimately, any problems arising from compliance with GPSR are an unavoidable consequence of leaving the single market.

Footnotes

[1] The definition of an economic operator has been retrieved from the text of the regulation which cross refers to Regulation (EU) 2019/1020 Article 4(2).

[2] An online marketplace, according to Article 3(14) is defined as a provider of intermediary services that allows consumers and traders to conduct distance sales.

[3] Article 19(b) (EU) 2023/988 General Product Safety Regulation.

[4] Article 44 of Regulation (EU) 2023/988

[5] SkyNews, The I paper, Leading Britain’s Conversation

[6] The information has been recorded as a response when participants were asked to report major obstacles relating to UK exit from EU: Increase in cost of exports to the EU. (Base: All SME Employers that consider Brexit a major obstacle in Cohort B)

[7] https://www.gov.uk/government/news/government-announces-20-million-sme-brexit-support-fund

[8] SkyNews, The I paper, Leading Britain’s Conversation

Disclaimer:

The opinions expressed in this blog are those of the author alone and do not necessarily represent the opinions of the University of Sussex or the UK Trade Policy Observatory.

Republishing guidelines:

The UK Trade Policy Observatory believes in the free flow of information and encourages readers to cite our materials, providing due acknowledgement. For online use, this should be a link to the original resource on our website. We do not publish under a Creative Commons license. This means you CANNOT republish our articles online or in print for free.